top of page

Search

Crowd Dynamics and Behavior

Unification_Relativité Générale_Mecanique Quantique_Expansion Univers

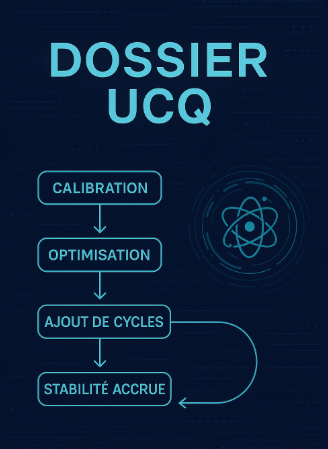

The Cosmological-Quantum Unification Formula (UCQ) proposes a unified theoretical framework to model the probability P(t) of convergence toward privileged states in cosmology and quantum mechanics, integrating a wave function ψ[ϕ(t), gμν(t), M(t), O(t)], an effective action S_eff, a complementary Lagrangian L_comp to regularize singularities, and a certainty term L_cert to reduce uncertainty.The dynamic memory M(t), enriched with temporal cycles, captures non-local effects, e

Theoretical and Methodological Framework of the CBD Formula_Monte Carlos

The CBD formula models collective dynamics (crowds, markets, AI) using a nonlinear deterministic framework, with variables such as thresholds (S, R), memory (M), and energy (V). Monte Carlo simulations (10,000 iterations) show an asymmetric distribution capturing realistic instabilities without pure randomness. Sensitivity analysis (OAT and Sobol) identifies M and V as key amplifiers, with moderate interactions confirming robustness. Empirical and logarithmic validation revea

A whimsical question about numbers : Universal Numerical Structure from 1 to 9

Observable reality (markets, crowds, cycles) is not chaotic but structured by universal states (1–9), thresholds of collective memory (Fibonacci), and fractal dynamics. The formula P(t) is its functional expression, linking psychology, perception, and direction to produce the observable phenomenon. Perfect numbers mathematically confirm this coherence: despite complexity, everything converges toward unity, then begins again.

Robot LWJS V21x32

The robot automatically analyzes market trends using a multi–timeframe system. It detects bullish, bearish, and neutral phases and generates signals aligned with overall market dynamics. Its model uses several “virtual contracts” with different profit objectives to smooth performance. It adapts to many asset classes (indices, cryptocurrencies, etc.) and results vary depending on volatility. All performances are based on real historical data, but they never guarantee futur

LWJS Screener Market Phase +MTF

The LWJS Screener MTF is a Pine Script v6 indicator that analyzes multi-timeframe market phases (15 min, 1 h, 4 h, D1, W1, M1) for a ticker, using RSI, MACD, ATR, and volume to detect bullish, bearish, or neutral trends. It calculates phases per timeframe via request.security , checks for complete or partial alignments (bullish/bearish), and highlights immediate weekly (MH/MB) activations with visual labels such as ▲, ▼, W▲, W▼. The inputs allow customization of parameters (

bottom of page